Get in Touch

Do you need consultation, are interested in purchasing one of our products or have a project in mind? We would love to hear from you!

Alpha Quantum Portfolio Optimiser is a state of the art software solution for portfolio optimization and asset allocation, used in mutual funds, wealth managers, insurance companies, pension funds. Our Portfolio Optimiser can also serve as a portfolio optimisation solution for robo advisors.

Download Risk Management Presentation

Powerful multiperiod portfolio optimization framework for backtesting and research of strategies

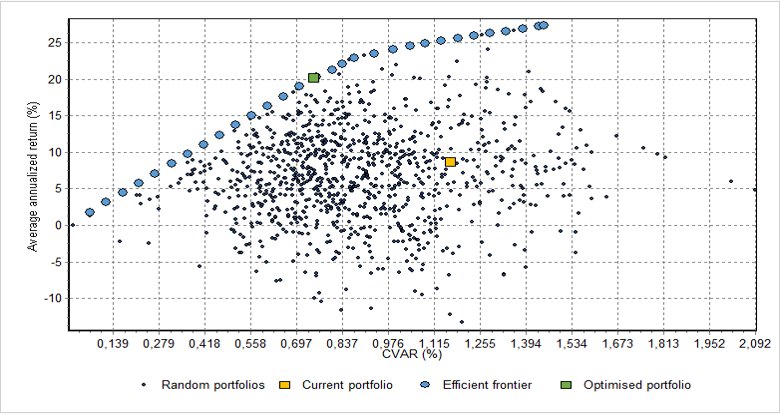

Various risk metrics: mean variance, mean cvar and other

Use of deep learning neural nets in backtesting of strategies

Powerful reporting and document generation capabilities

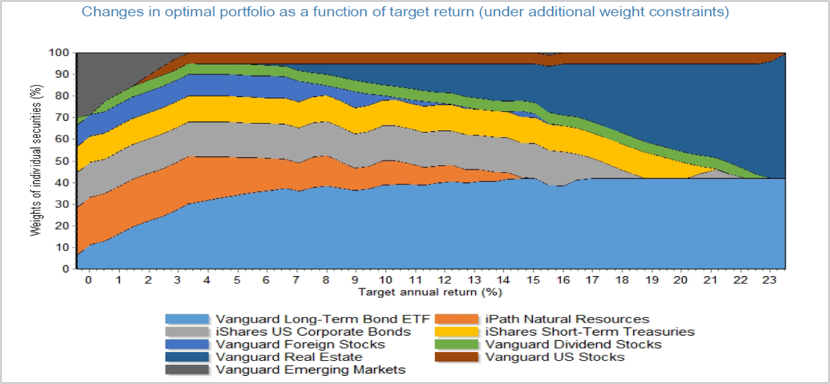

Mean variance, mean cvar, mean cdar optimisation

Different formulations: target risk, target return, risk aversion formulation

Support for many different constraints: weights of securities, asset classes, tracking error, etc.

Efficient Frontiers for mean variance, mean cvar optimisations

Powerful multiperiod portfolio optimization framework for backtesting and

research of strategies

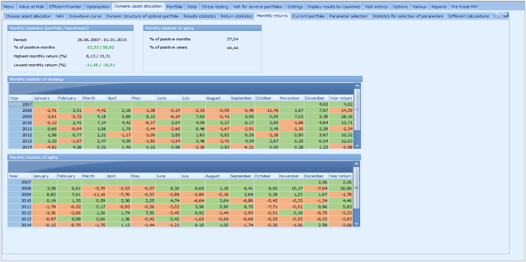

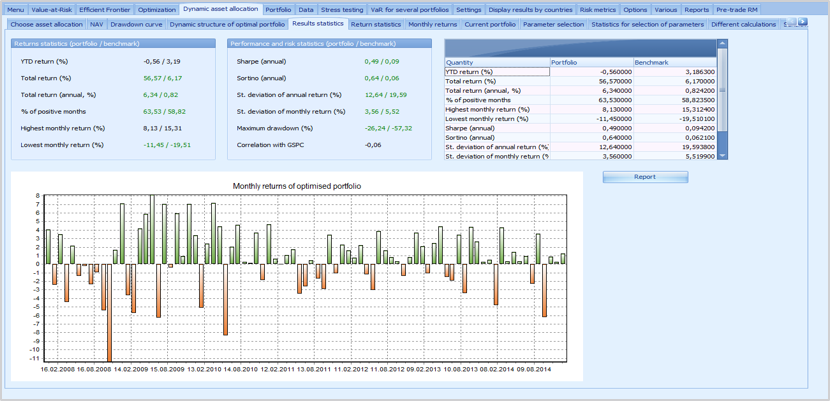

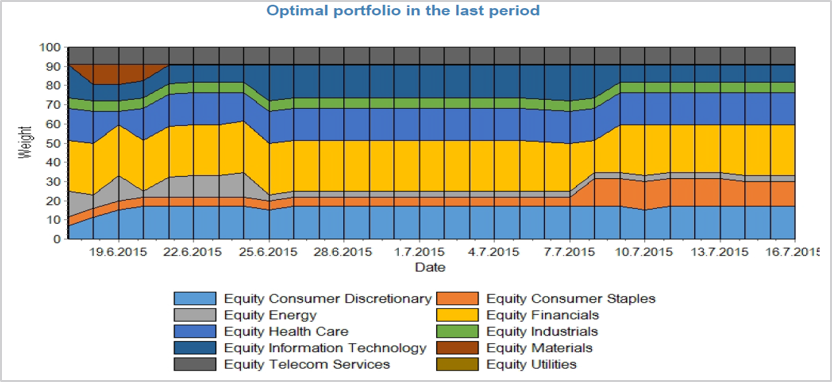

Detailed statistics for backtesting results: NAV, drawdown, dynamic structure curves, many

different performance and risk quantities (sharpe, sortino, etc.)

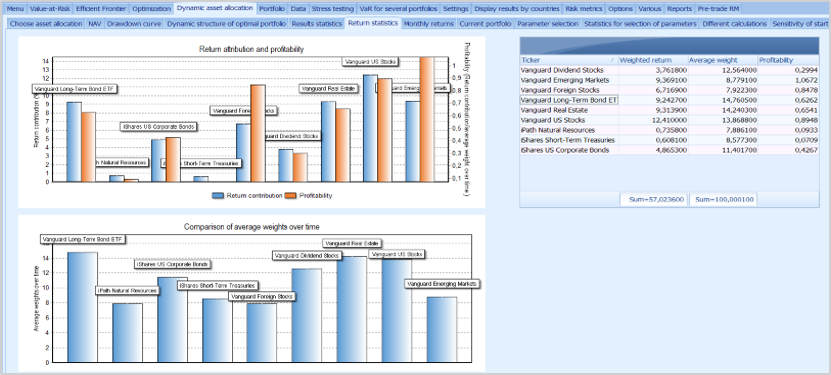

Detailed return attribution for multiperiod investment strategies

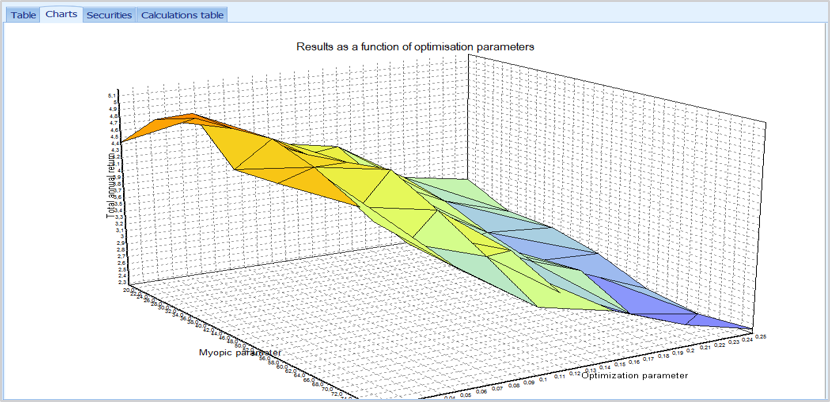

Backtesting for a wide multidimensional grid of investment strategy

parameters. Jobs can be defined and saved in bulk for processing in multithread

environment

Optimal weights of all active portfolios can be calculated with batch requests on intraday, daily

basis or other periodic intervals

Continuously optimized portfolios can be easily exported via API to broker solutions

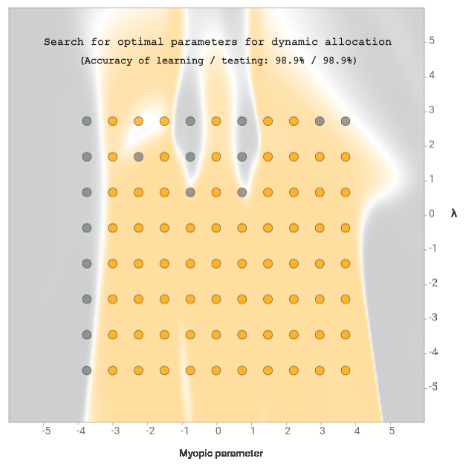

Use of deep learning for automating search for optimal parameters in

backtesting results with multidimensional manifolds

Our AI solutions and tehnologies (face detection, voice recognition, etc.) enable us to build

digital assistants that can be specialised also also to asset management industry

AiDA is our specialised digital asistant for portfolio optimization

Alpha Quantum Portfolio Optimiser has powerful reporting capabilities. Reports can be generated in various formats, including PDF, Excel, Word, XML and many others. Examples of reports for portfolio optimisation, multiperiod backtesting report and report on active portfolios and strategies, respectively:

Do you need consultation, are interested in purchasing one of our products or have a project in mind? We would love to hear from you!