Get in Touch

Do you need consultation, are interested in purchasing one of our products or have a project in mind? We would love to hear from you!

Alpha Quantum Risk Management is a risk management solution for a wide variety of companies in financial services industry:

mutual funds, hedge funds, robo advisors, wealth managers, insurance companies, pension funds.

It has been implemented on over 1 billion USD of assets in asset management and insurance companies.

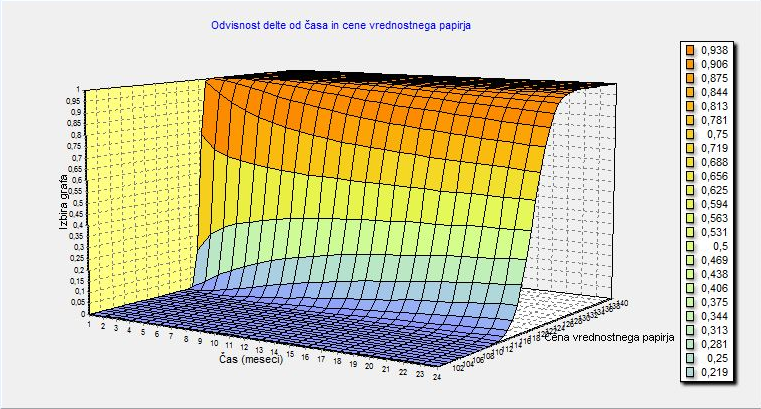

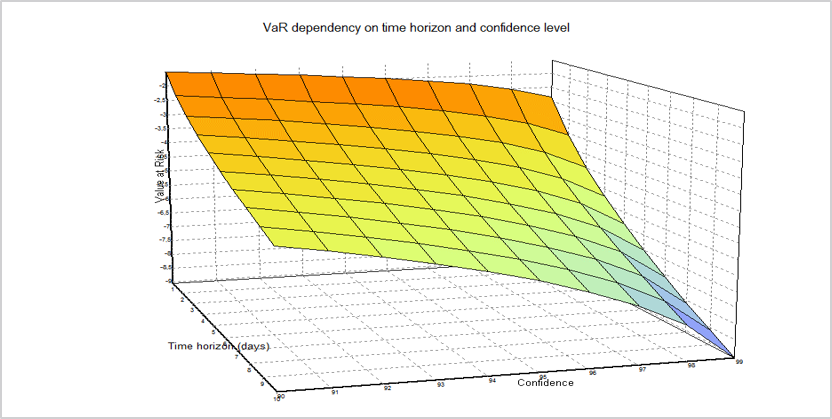

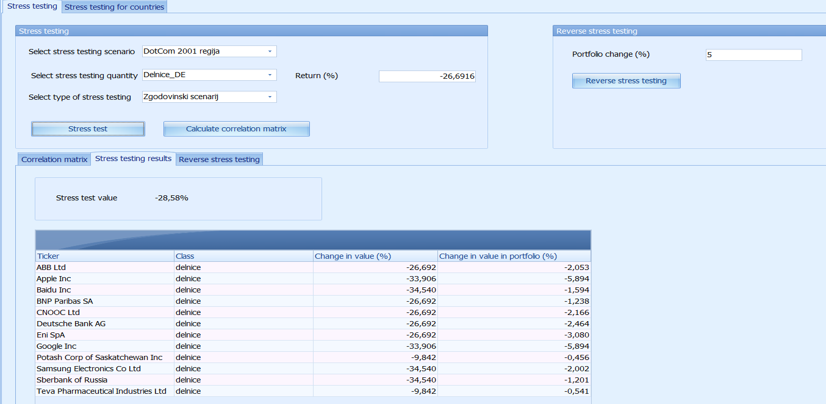

Our solution allows clients to conduct risk analysis through different Value at Risk methods, construction of stress test scenarios, support for derivative positions, pre-trade risk management and risk attribution

The features also include limits monitoring, performance measurement, regulatory compliance and powerful reporting capabilities for credit risk, market risk and portfolio analysis

Our Eneterprise Risk Management Software includes supports a wide array of risk management metrics and features.

Value at Risk (VaR), CVaR, Maximum Drawdown, CDaR

Normal distribution, non-normal distribution (t-Student and Cornish Fisher expansion)

Historical, variance-covariance and Monte Carlo simulation

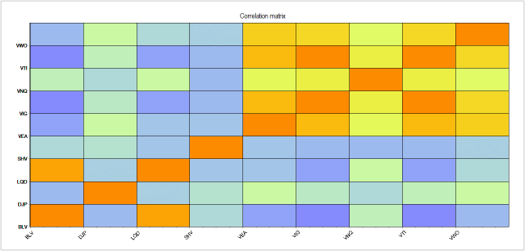

RMT (Random matrix theory) construction of correlation matrix

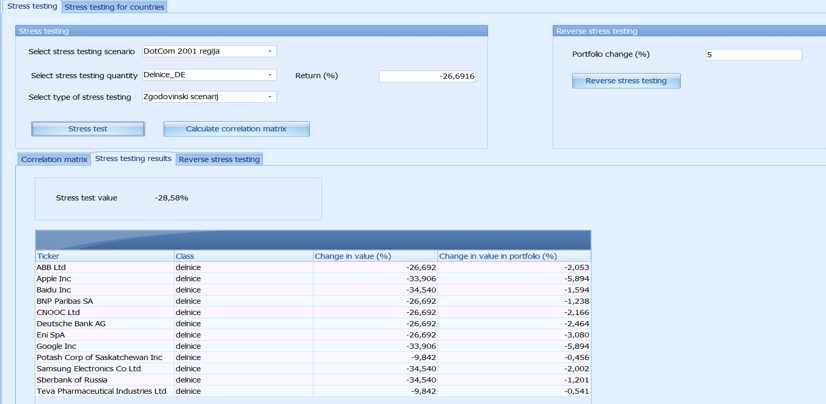

Historical and custom scenarios

Stress test with changed correlations

Support for majority of financial variables

Reverse stress testing

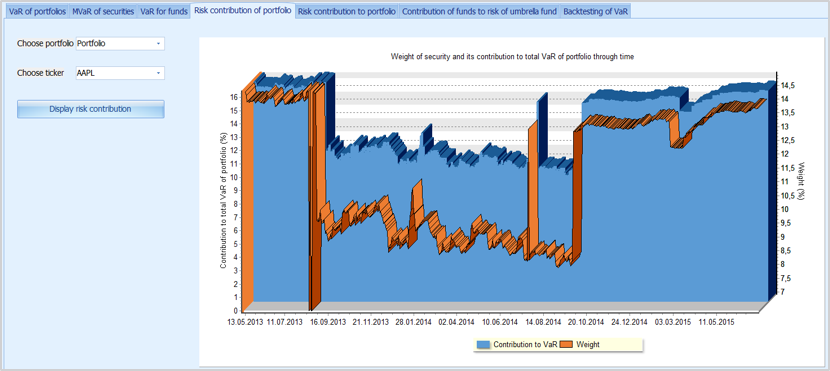

Marginal, component VaR

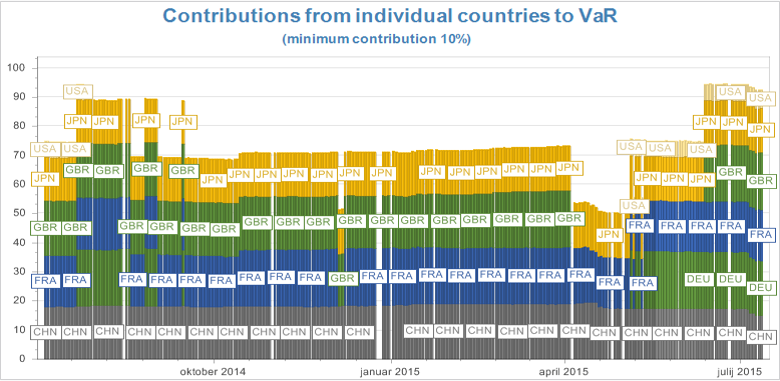

Contribution to total VaR of portfolio: individual securities, asset classes, currencies, countries, sectors, credit risk and liquidity

Time dependency, analysis and coupling to performance attribution

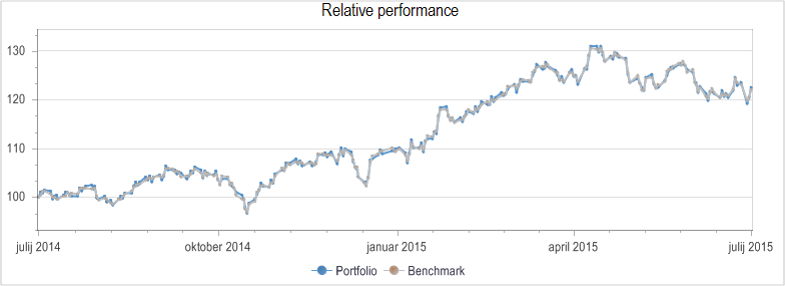

Monitoring of active bets against benchmark

Performance and risk measurement with various indicators

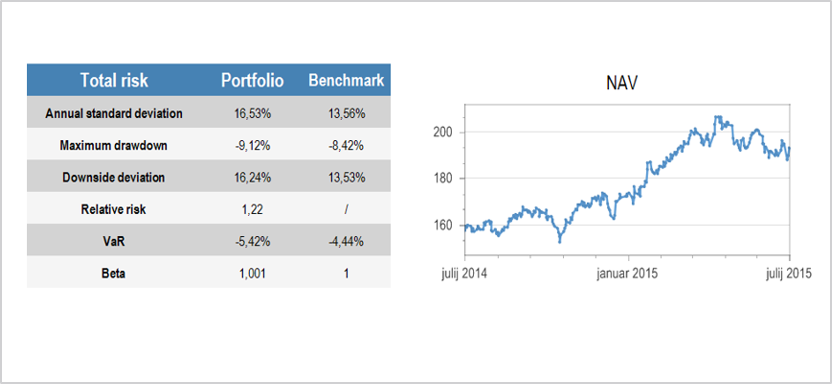

Absolute risk: standard deviation, downside deviation, Maximum Drawdown, VaR, etc.

Systematical risk: beta, tracking error

Performance indicators: Sharpe ratio, Treynor ratio, information ratio, Jensen‘s alpha, etc.

Alpha Quantum Risk Management has powerful performance reporting, supporting many performance indicators, including Information ratio, Sortino ratio, Sharpe ratio, Jensens alpha, etc. Our performance analysis and reporting is ideally suited for fintech companies who want to integrate performance reporting in their products. Generation of reports can also be automated either locally or on server. Reports can be generated in various formats, including PDF, Excel, Word, XML and many others. Example of report:

Alpha Quantum Risk Management has powerful reporting capabilities. Our risk analysis and reporting is ideally suited for fintech companies who want to integrate advanced risk reporting in their products. Reports can be generated in various formats, including PDF, Excel, Word, XML and many others. Examples of reports for portfolio risk analysis and pre-trade risk management, respectively:

Do you need consultation, are interested in purchasing one of our products or have a project in mind? We would love to hear from you!