Get in Touch

Do you need consultation, are interested in purchasing one of our products or have a project in mind? We would love to hear from you!

Alpha Quantum Quantamental is an innovative solution for financial analysis, valuation and ranking of companies and a backtesting platform for quantitative strategies

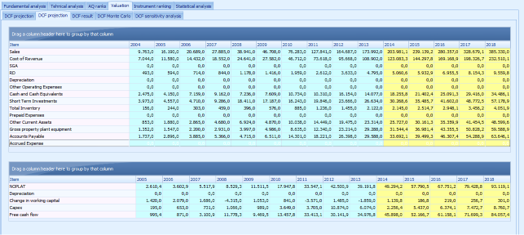

Our solution allows clients to conduct financial analysis of companies,

including generating sophisticated automated reports and provides versatile discounted cashflow valuation tools.

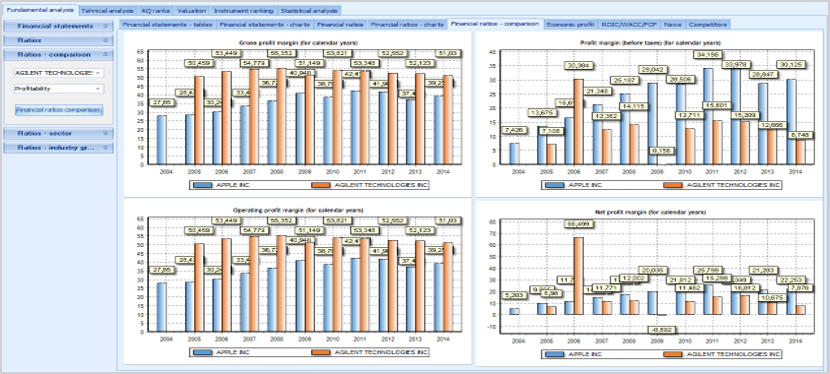

Support for over 30 financial ratios and indicators in categories of profitability, activity, solvency, liquidity, growth and returns

Automated generation of sophisticated and complex reports which include segments of financial analysis, valuation, ranking and news analytics

Many different types of automated reports – value investing, credit risk and others

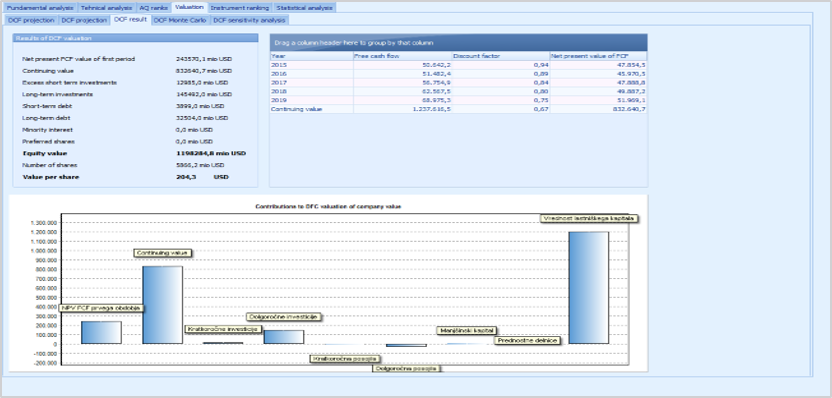

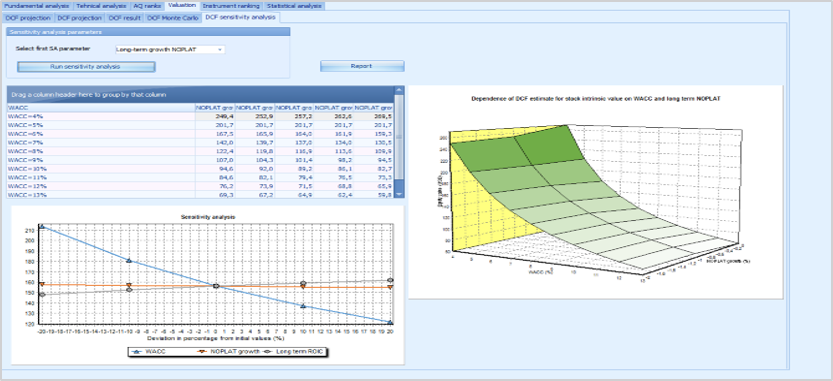

Discounted cashflow valuation (DCF, FCFE model)

Estimate of stock intrinsic value distribution with DCF Monte Carlo simulation

Support for many different scenario classes for projection (historical, customised). Versatile sensitivity analysis of DCF valuation

Bulk generation of DCF results as an input to further analysis and for quantitative investment strategies

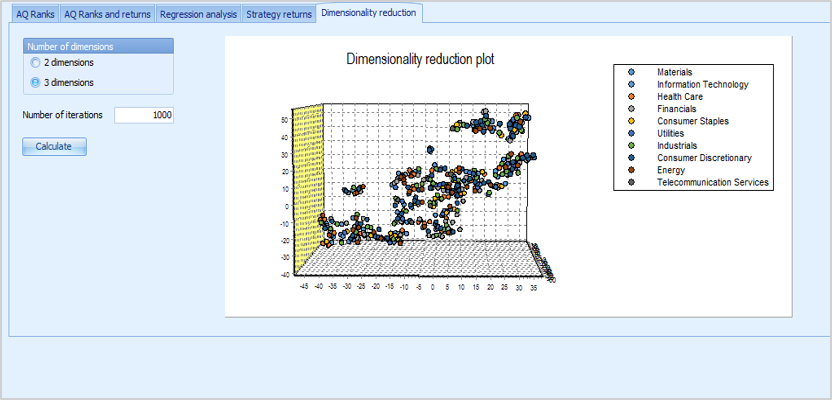

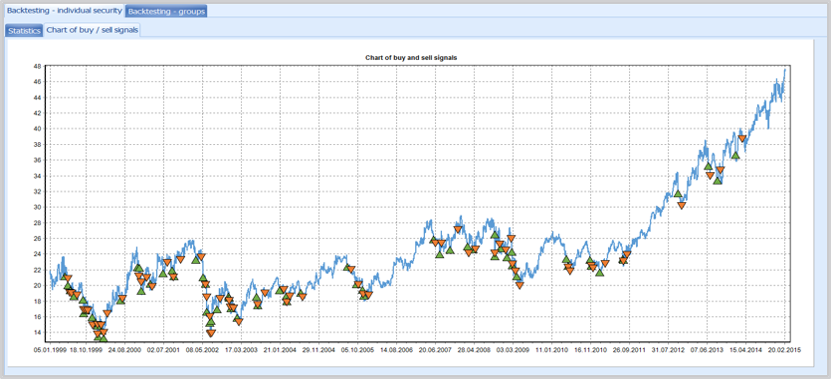

Powerful framework for backtesting and research of quantitative strategies

Quantitative strategies can be based on multifactor models, pricing models, rankings, DCF valuations, news analytics models or their combinations

Automation and API connections with broker solutions

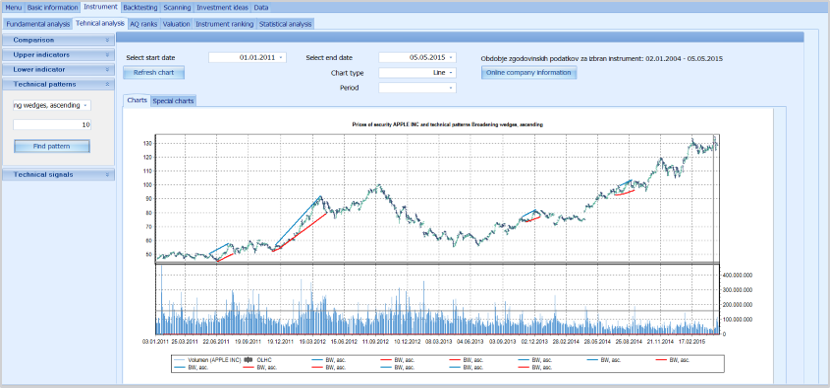

Many chart styles (including Bars, Line, Candlesticks, Point & Figure, Renko)

Support for many standard technical signals and indicators, including Bollinger bands, MACD, RSI, stochastic, momentum, volume oscillator

Automatic algorithmic recognition and drawing of standard technical patterns, including double top/bottoms, wedges, triangles. Support for bulk scanning

Do you need consultation, are interested in purchasing one of our products or have a project in mind? We would love to hear from you!