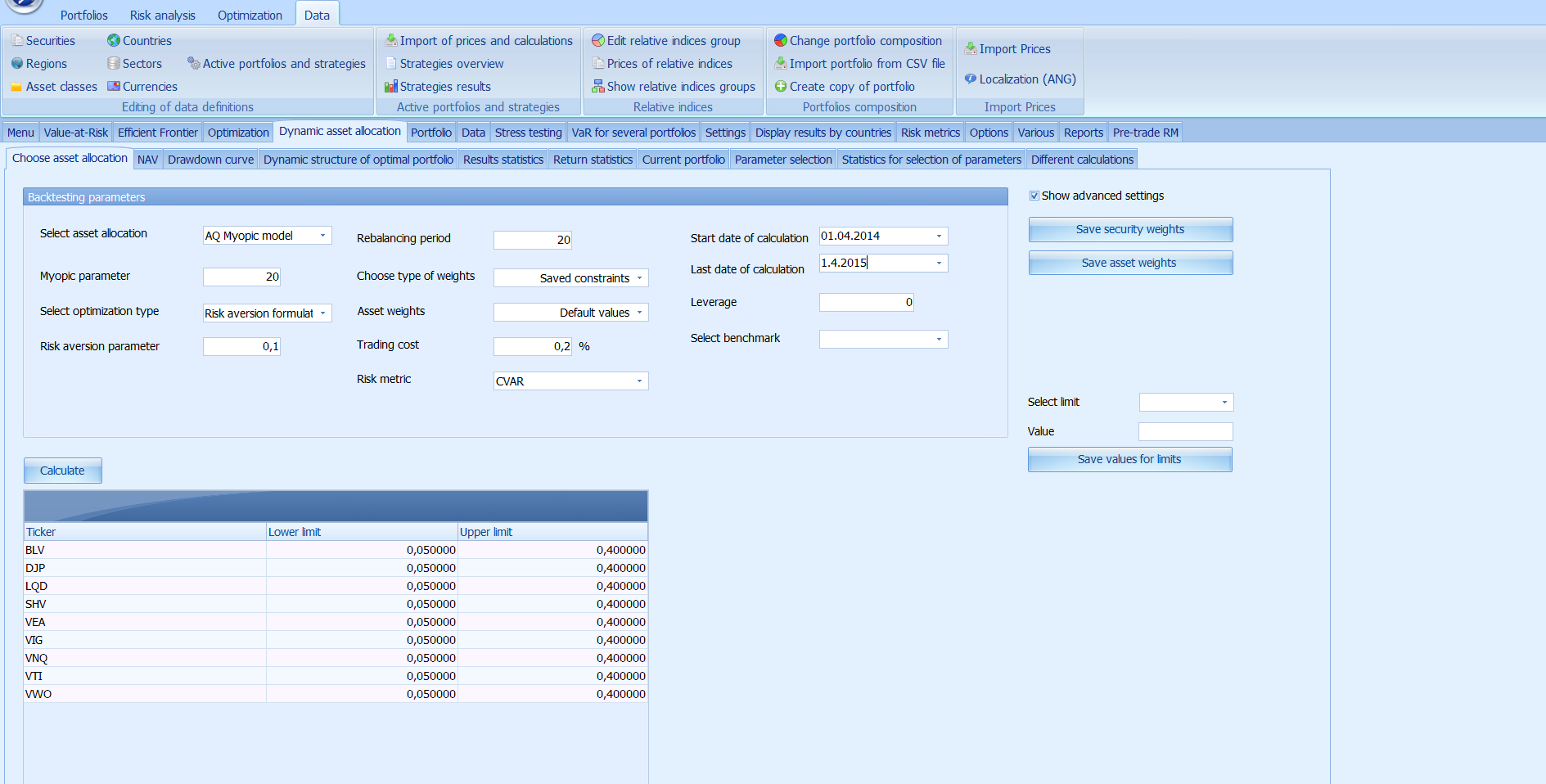

In calculating optimal portfolios, the software may select analysts' expectations, historical averages or the results of more complex models of expected returns on stocks or bonds for the expected returns on securities.

Since 1952 and Harry Markowitz's Nobel Prize-winning paper, portfolio optimization has been based on the so-called Mean Variance methodology, which assumes the standard deviation of returns as a measure of risk.

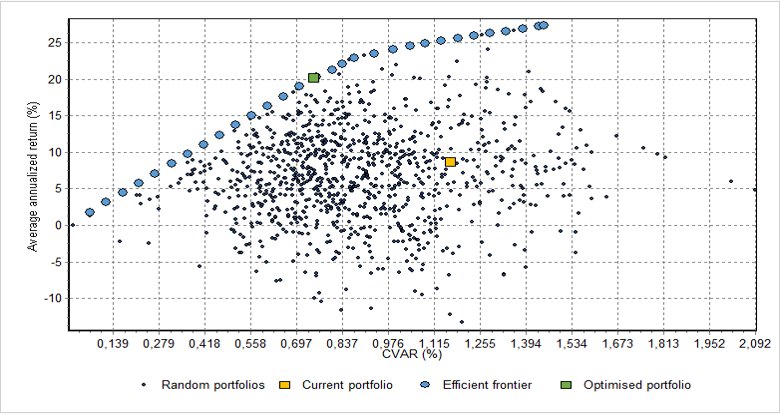

Over the last ten years, however, classical portfolio optimization has gradually been replaced by the more advanced Mean CVaR methodology, where the risk measure is CVaR. Morningstar has described the Mean CVaR methodology as the future of portfolio optimization. Unlike standard deviation, CVaR takes into account higher moments of the return distribution and thus describes portfolio risks much better, especially during periods of extreme market events.

Mean CVaR methodology

In the Mean CVaR methodology, the measure of portfolio risk is the CVaR or Conditional Value at Risk, which is the weighted average sum of losses that equal or exceed the VaR at a given confidence level. While VaR only tells us the minimum loss we will suffer at a given confidence level, CVaR is more telling as it gives us an indication of how much we will lose on average when extreme, so-called tail events occur.The sensitivity of the Mean CVaR method to extreme events in the markets makes the software solution suitable for asset management in any situation in the capital markets.

Formulations

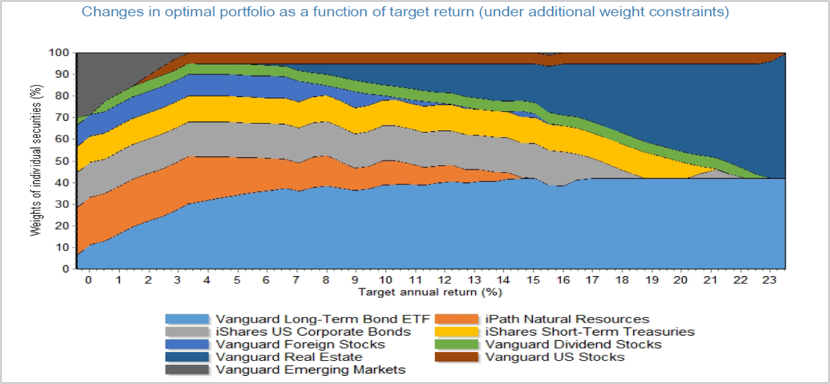

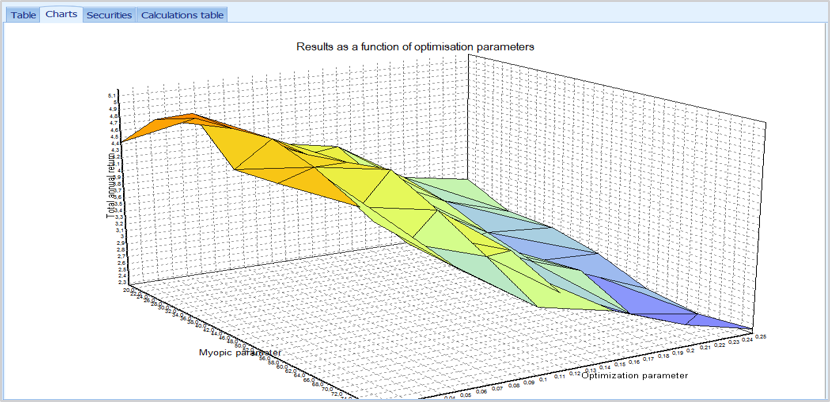

Portfolio optimization can be carried out under three formulations, determining the portfolio that has (1) the maximum return for a given risk, (2) the minimum risk for a given target return, or (3) the highest risk-adjusted return among all portfolios.The first formulation is, for example, appropriate for insurance companies, and will be particularly so after the introduction of Solvency II, which will define an insurance company's capital as VaR. In mutual fund asset management, it can be used to determine the optimal composition of funds that maximise return for the same risk as the benchmark fund.

The search for a portfolio with minimum risk for a given return is, among other things, suitable for pension companies that need to achieve a minimum return for their policyholders. The risk-adjusted return formula allows for optimal investment advice to clients while taking into account their individual risk appetite.

Constraints

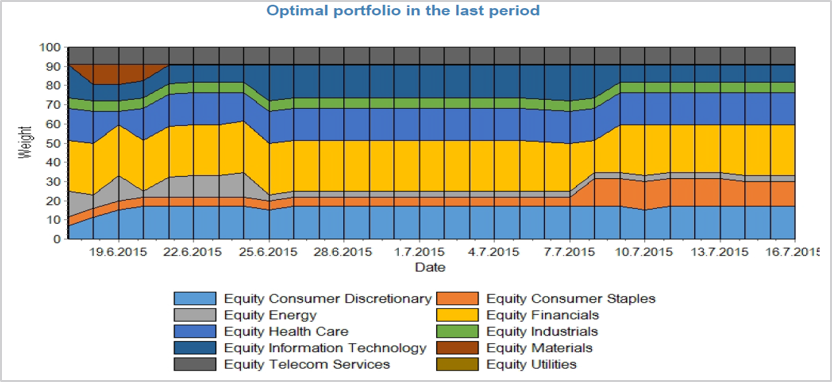

Alpha Quantum Portfolio Optimiser allows for a variety of constraints to be considered, including the setting of weight limits for individual securities, investment, liquidity, credit and other classes, and more complex constraints such as the inclusion of a target value for the tracking error of the portfolio. The scheme allows for all the constraints of internal investment policies, governance rules, fund prospectuses to be respected and is in line with the UCITS Directives.